Clergy Payroll & Housing Allowance

You have reached the page where we discuss all things

Clergy Payroll & Housing Allowance.

Below you will find the resources needed to make sure you are calculating and carrying out Clergy Payroll correctly. These resources will help ministers in their personal taxes as well as church administration.

We are providing these resources for FREE access to our brothers and sisters in Christ. Below you will find a video training, worksheet, and a place to reach out for help if you have further needs or questions.

Please note - this information is to help guide ministers in the right direction. Often times, ministers and church admins feel like they have no idea where to start. This is your starting point. We want to always emphasize that the relationship between you and your tax preparer is important. Please run any and all changes through them to make sure you are on the same page.

Video Course

This training is approx. 41 minutes long and answers the following:

What is a Clergy?

What is Housing Allowance?

What are the limits and regulations of Housing Allowance?

What are self-employment taxes?

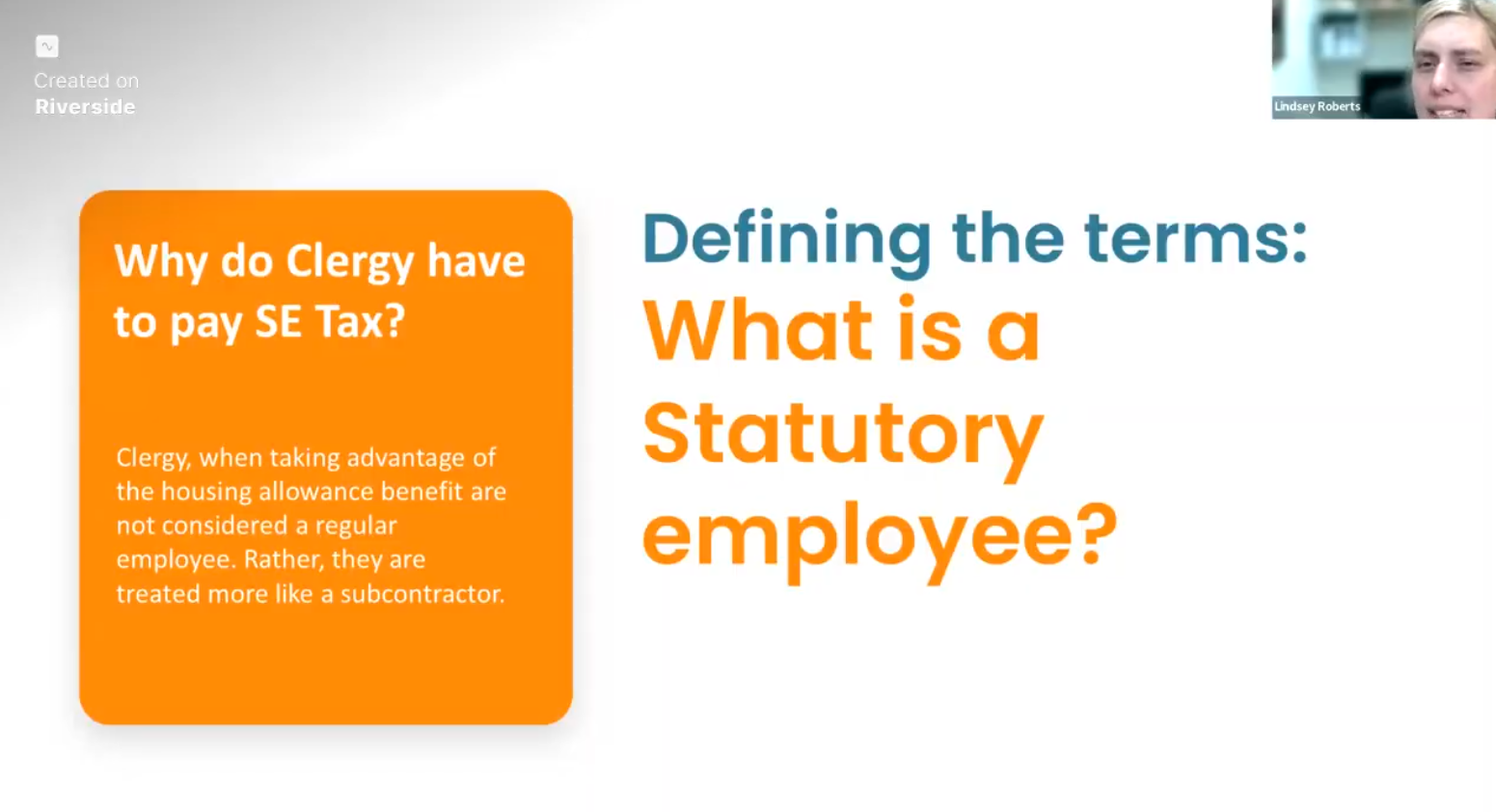

What is a Statutory employee?

What is a Social Security and Medicare Exemption?

Real life scenarios of tax situations.

What are considered living expenses?

How do I calculate what the ‘fair rental value’ is?

What do I need to do to get ready for income taxes?

Can my church help me with my extra tax burden?

What happens if not all the housing allowance is spent?

Can I change housing allowance mid-year?

What if my church is doing my payroll wrong?

This list is used to help you:

Calculate your housing allowance

Prepare information for your tax preparer to file your income tax return

Common Housing Allowance Expenses:

Rent or Mortgage Payments

Monthly rent for a residence

Mortgage principal and interest payments

Property Taxes

Taxes assessed on the property (if not included in the mortgage escrow).

Utilities

Electricity

Water and sewer

Gas or heating oil

Trash collection

Insurance

Homeowner’s or renter’s insurance premiums

Maintenance and Repairs

Routine repairs (e.g., fixing leaks, repainting)

Regular maintenance (e.g., lawn care, cleaning services)

Structural repairs and remodeling

Maintenance items (household cleaners, light bulbs, pest control, etc.)

Furnishings and Appliances

Costs to purchase or rent essential items like furniture, refrigerators, or stoves.

Association Fees

Homeowner’s association (HOA) dues

Condominium fees

Security Costs

Installation or maintenance of security systems

Security deposits

Lease or Agreement Fees

Initial lease signing fees or legal costs associated with housing agreements.

Special Allowances (Sometimes Included):

Parking fees associated with the residence

Internet and cable services (if deemed essential)

Exclusions (Often Not Covered):

Personal luxury expenses (e.g., pool maintenance not required by property rules)

Penalties for breaking a lease

TV/Cable subscriptions

Internet Services - but this would be deductible as a business expense

Free Download

Click HERE to download a free worksheet called

“Estimate Maximum Housing Allowance”.